XRP is riding its longest-ever winning streak against ETH, with six straight months of outperformance — but is this momentum sustainable?

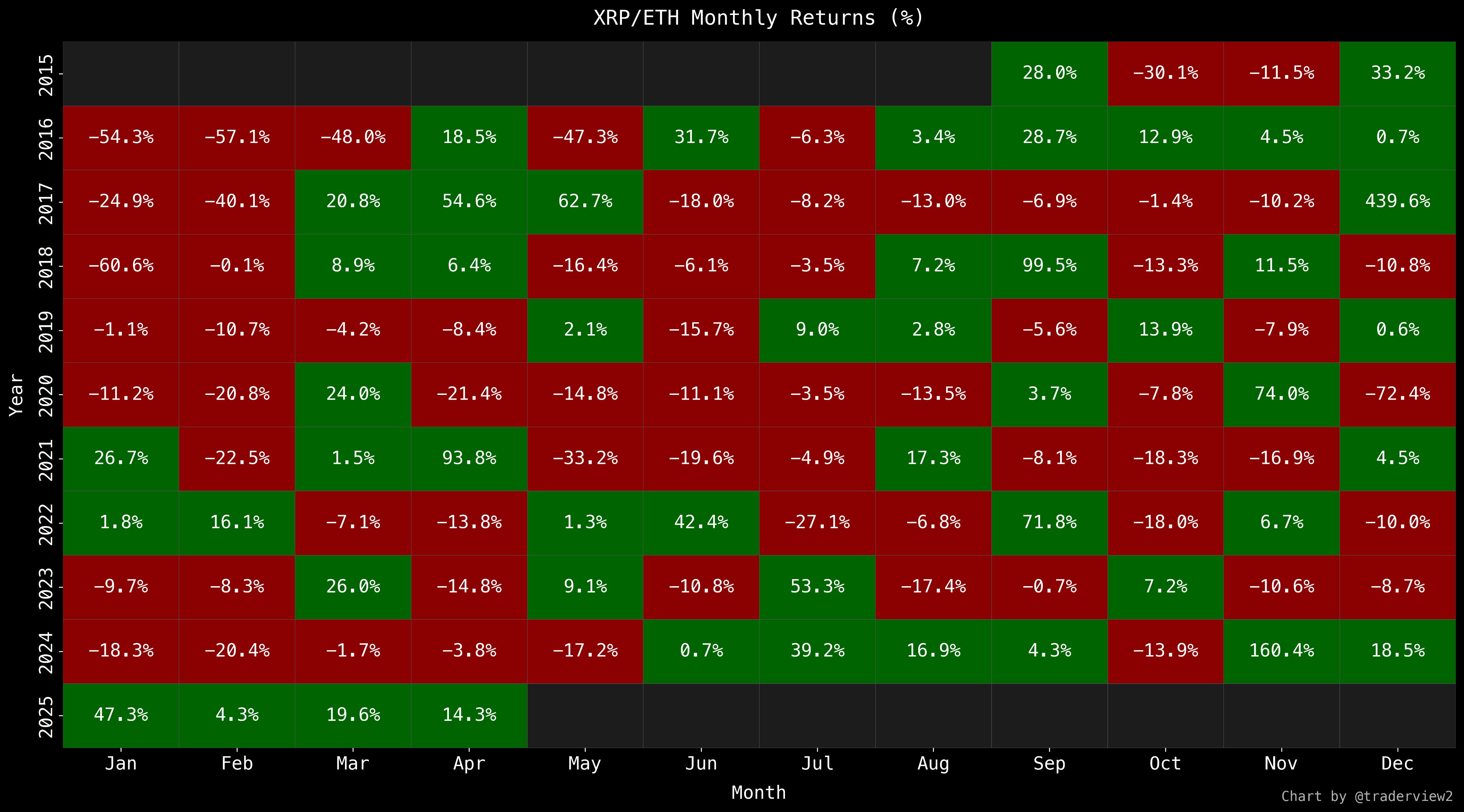

Ripple (XRP) has now outperformed Ethereum (ETH) for six consecutive months, marking its longest winning streak on record against ETH. The run began in November last year, when XRP surged by 160.4% relative to ETH. That momentum continued with gains of 18.5% in December, 47.3% in January, 4.3 in February, 19.6% in March, and 14.3% in April. Altogether, XRP has gained more than 264% against ETH during this six-month stretch.

Historically, XRP has rarely outperformed ETH for more than two consecutive months. So, this winning streak raises the question of whether the trend is sustainable.

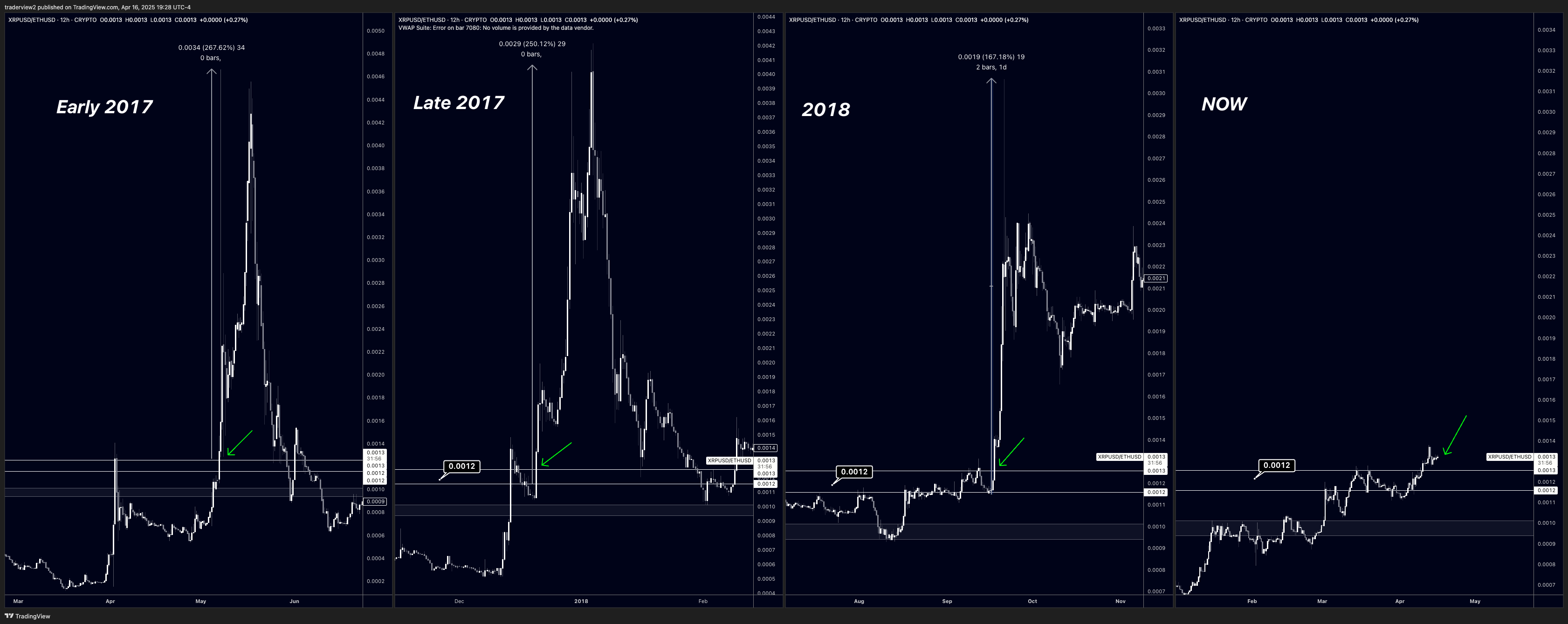

Crypto analyst Dom highlighted that XRP has also recently broken above a historically significant resistance level on the XRP/ETH chart (around 0.00022–0.00025 ETH range). He explained this level has held importance for over eight years, and in past instances (early 2017, late 2017, and 2018), XRP only began to accelerate once it flipped this zone into support. If the historical pattern holds, this could signal that XRP’s recent outperformance isn’t just a short-term anomaly but part of a broader shift in the XRP/ETH market dynamics between ETH and XRP.

Ripple’s recent performance can be attributed to several factors, most notably its inclusion in the U.S. strategic reserve and whispers that the SEC vs Ripple lawsuit may be nearing an end. Of course, let’s not forget about the potential upcoming spot XRP exchange-traded fund, which has 77% of approval in 2025, according to Polymarket.

While XRP gains steam, Ethereum has been hit with a series of setbacks that put a dent in investors’ confidence.

According to Binance research, the upcoming upgrades Pectra and Fusaka may potentially weaken Ethereum’s revenue model because they’re mainly geared toward L2s that operate on top of Ethereum. As a result, both upgrades could erode Ethereum’s value accrual, putting downward pressure on the price as investors question the long-term profitability of holding ETH.

Ethereum’s fundamentals have also weakened sharply. Data from DeFiLlama shows that Ethereum’s total value locked has plunged from approximately $70 billion at the beginning of the year to $46 billion, while its monthly revenue has collapsed from $109 million in January to just $7.2 million in March. On top of that, ETH ETFs continue to see outflows.

As for Ethereum’s price itself, it has recently fallen into a multi-year trading range and is now hovering near its midpoint. Unless buyers step in soon, ETH is at risk of rotating down to the range low — a level that could either trigger a major bounce or a breakdown below $1,000.

So, whether XRP’s winning streak is sustainable remains to be seen — but for now, the momentum is clearly in its favor.