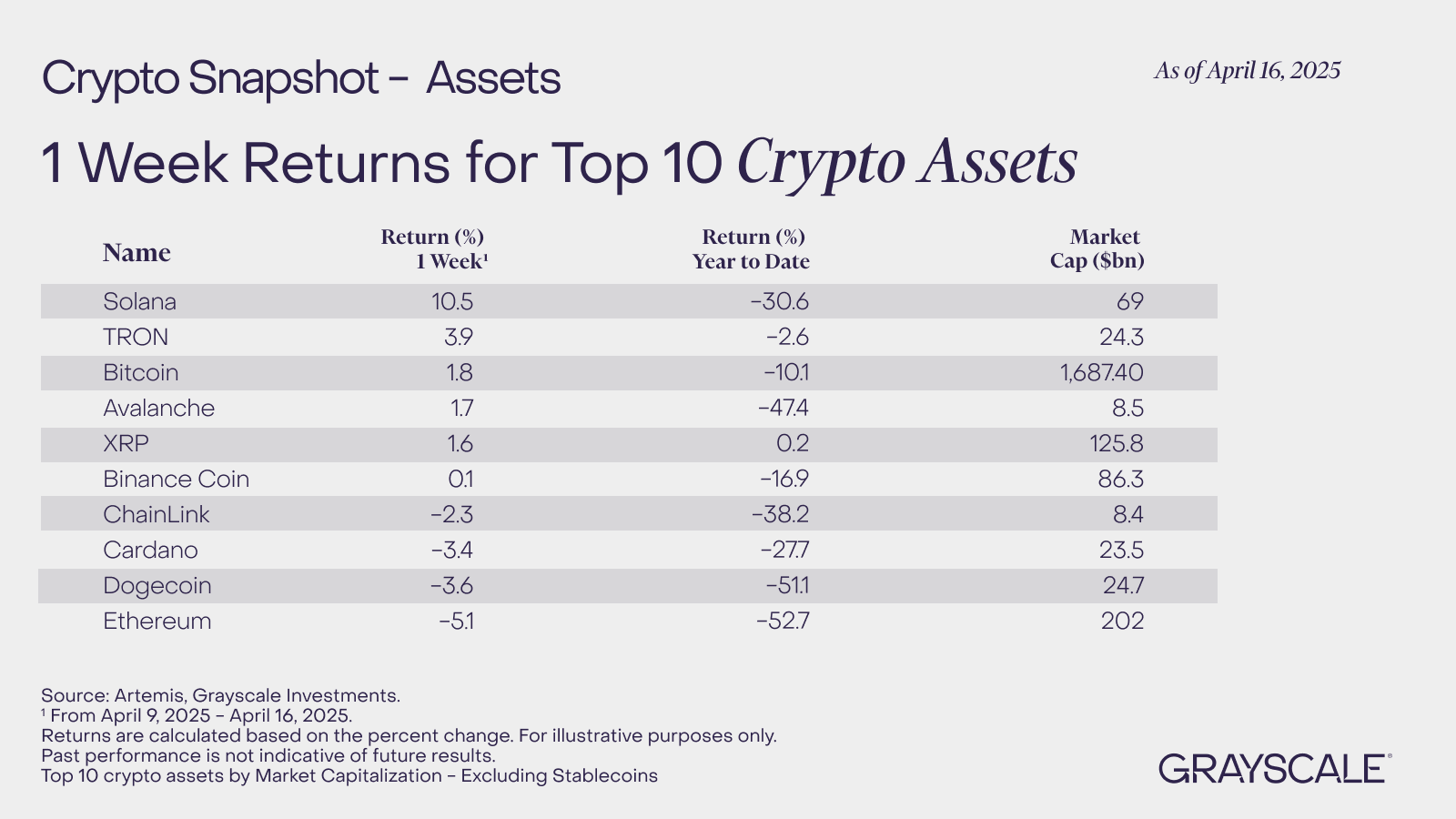

XRP rallied 2% in the past week, and nearly 1% on the day, bucking the typical trend of correction in the crypto market. The second-largest altcoin by market capitalization ranks among the top 10 gainers, according to Grayscale data.

XRP (XRP) is the third-largest cryptocurrency by market capitalization and is the only altcoin with positive year-to-date gains, compared to Bitcoin (BTC), Ethereum (ETH), and other tokens. XRP trades at $2.0615 at the time of writing.

XRP leads top 10 cryptos in year-to-date gains

Grayscale analyzed the year-to-date returns of the top 10 cryptocurrencies, and XRP led the group with a positive 0.2%. The remainder of the nine cryptos have plummeted in the same timeframe, while XRP holds on to gains.

XRP price is up 278.95% in the last six months and the altcoin buck the downward trend in altcoins and Bitcoin, and Liberation Day decline in prices. XRP shows resilience with 1.6% weekly returns and a market capitalization of $125.8 billion, as noted by the asset management giant.

Bullish catalysts could push XRP price higher

The resolution of the U.S. Securities and Exchange Commission’s lawsuit against Ripple propelled the altcoin back to its position as the second-largest altcoin. For years XRP slipped lower in the ranks, while Ethereum alternatives and meme coins challenged its position in the top 10 cryptos.

The $50 million settlement between the SEC and Ripple closed the litigation for the firm and catalyzed a massive rally in XRP price.

The regulatory clarity from the Trump administration lifted a cloud from XRP’s muted performance and sparked a renewed interest in the altcoin from market participants. The number of active addresses on the XRP chain climbed from 16,826 prior to Trump’s return (pre-election) to over 100,000 at its peak in December 2024.

Ripple and its executives have strategically increased their influence in Washington DC through its donations to Political Action Committees, a close relationship with the Trump administration and XRP’s mention in the list of potential assets to be included in a strategic crypto stockpile in the U.S.

Several XRP ETF proposals have been filed and appear to be strong contenders for approval in 2025, emerging as another catalyst for the altcoin.

XRP price prediction, 100% gains likely

Technical analysis of the XRP/USDT daily price chart shows that momentum indicators support a bullish thesis for the altcoin on a daily timeframe. A descending triangle appeared to be formed in XRP price, from its $3.40 high to the $1.6134 low, meaning a bullish breakout is likely in the altcoin.

A descending triangle breakout has the potential to push XRP to gain 21% and test resistance at $2.50, an 88.85% rally could push the altcoin to test $3.8860 level, a 127.20% rally in XRP. XRP could post nearly 120% gains and climb to a peak of $4.5041.

The MACD flashes green histogram bars, signaling an underlying upward trend in XRP price. RSI is hovering close to the neutral level, at 46.

If the breakout fails and XRP price does not close a daily candlestick above the $2.50, then the altcoin could test support at $1.770.

On-chain and derivatives analysis

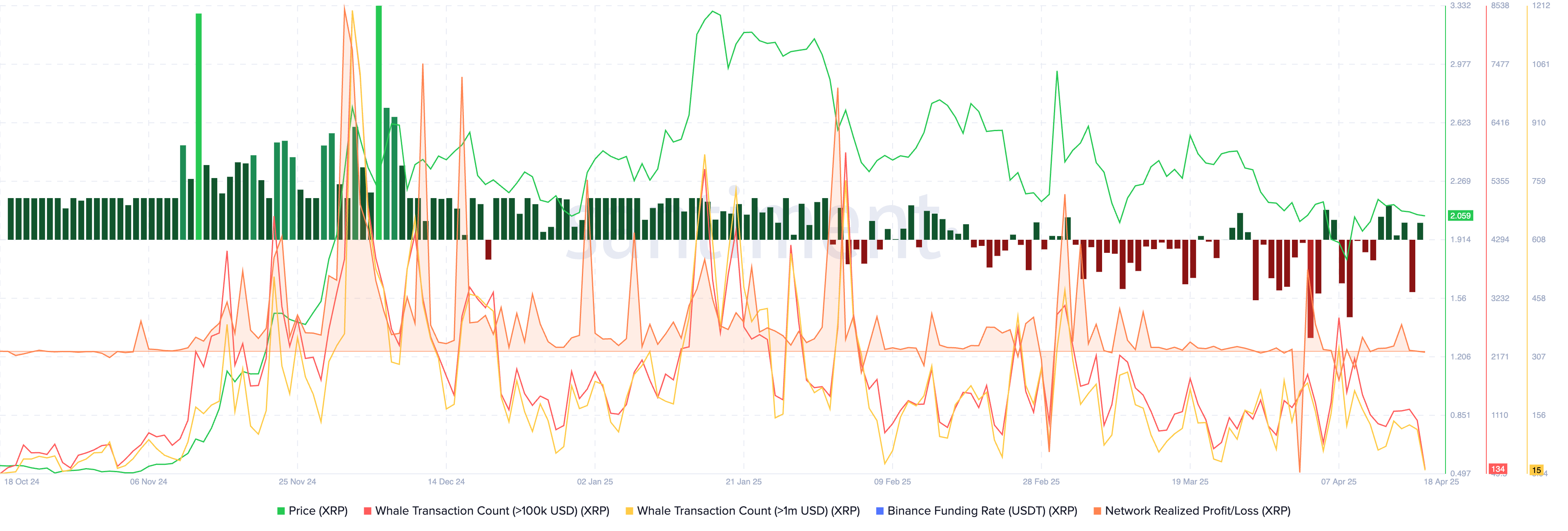

On-chain indicators support further gains in XRP. Santiment data shows that the funding rate on Binance is positive, meaning short positions are paying for longs and there is a likelihood of XRP price rallying.

Network realized profit and loss metric that identifies the net profit/loss of all tokens that were moved on a given day reads 4.41 million in losses. XRP traders have shed their holdings at losses, however this appears to be limited to retail participants, as whale transactions valued at $100,000 and higher and $1 million and higher.

Derivatives data shows the open interest, meaning the value of all open positions in XRP is $3.14 billion. This is above the 2025 average and the altcoin is relevant among derivatives traders.

The long/short ratio is under 1 on the 24-hour timeframe; however, on Binance and OKX, it exceeds 1, reads 2.1616 and 1.88, respectively. Traders are bullish on XRO.

The net liquidation is $2.68 million, relatively low compared to market crashes.

Ripple’s latest institutional push, XRP set to gain

HashKey Capital, a crypto fund manager, announced the launch of the HaskKey XRP tracker fund on Friday. It is the first investment fund in Asia that is set to track the performance of XRP and is available for professional investors without direct ownership.

The fund announced that this is the first of many collaborations planned between HashKey and Ripple, and the payment remittance firm will feature as an anchor investor.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.