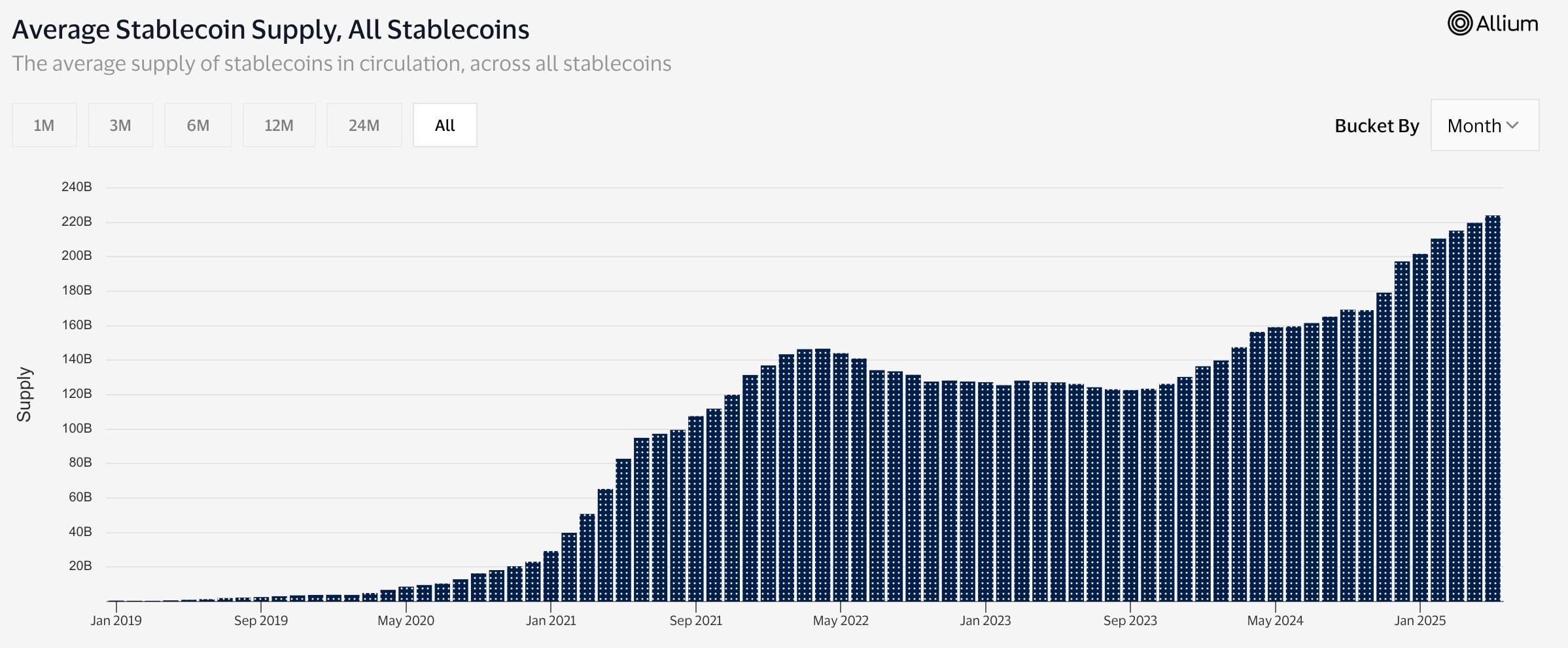

Stablecoins, like Tether USD Coin, continued their strong growth this week, with their market capitalization hitting a record of $243.8 billion.

These coins have added over $38 billion in assets since they started the year with $240 billion. Tether (USDT) boasts a market cap jumping to over $151 billion, giving it a dominance of 62%.

It is followed by USD Coin (USDC), which has $60.4 billion in assets, and Ethena USDe (USDe) with almost $5 billion.

The recently launched USD1 by President Donald Trump’s World Liberty Financial has gained over $2.1 billion in assets. Most of these funds are likely tied to MGX’s $2 billion investment in Binance, the biggest crypto exchange in the industry.

Other notable stablecoins are Ripple USD (RLUSD) and PayPal’s PYUSD, which have accumulated assets of $900 million and $313 million, respectively.

Data compiled by Visa shows that more people are using stablecoins in their daily transactions today. Over 192.2 million unique sending addresses have transacted in the last 12 months, while 242.7 million have received stablecoins. The total active unique addresses jumped to 250 million.

All this has pushed the total transaction count to 5.8 billion and the transaction volume to $33.6 trillion.

Stablecoins have become highly popular because of their lower costs compared to traditional methods. For example, sending $1,000 to a user through PayPal attracts a 2.99% fee plus a variable fee.

Using a stablecoin attracts a significantly smaller fee than that. Also, these transactions are faster than traditional methods like wire transfer.

Citi believes that stablecoins will continue gaining market share in the coming years.

In a recent report, the company estimated that stablecoins will be worth over $1.6 trillion by 2030, while Standard Chartered estimates that they will reach $2 trillion by 2028.