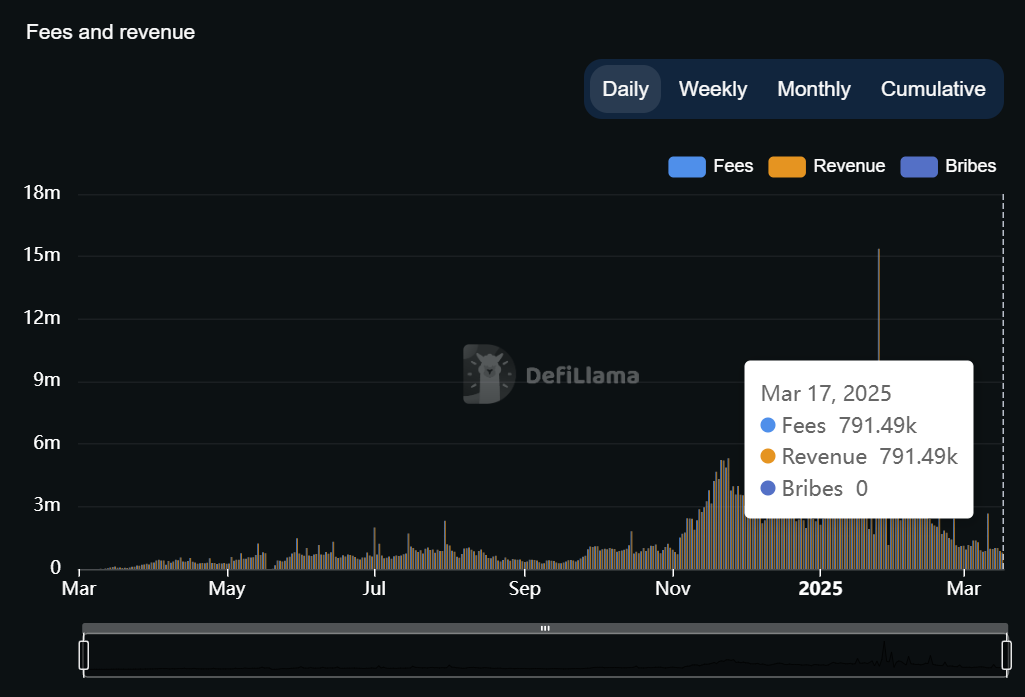

Pump.fun’s revenue has hit a 4-month low, driven by a bottoming-out of its token graduation rate.

According to DefiLlama data, Pump.fun’s protocol fee revenue is at $791,500 as of Mar. 17, a 94% drop from the $15.38 million peak on Jan. 25. This marks its lowest single-day value since November.

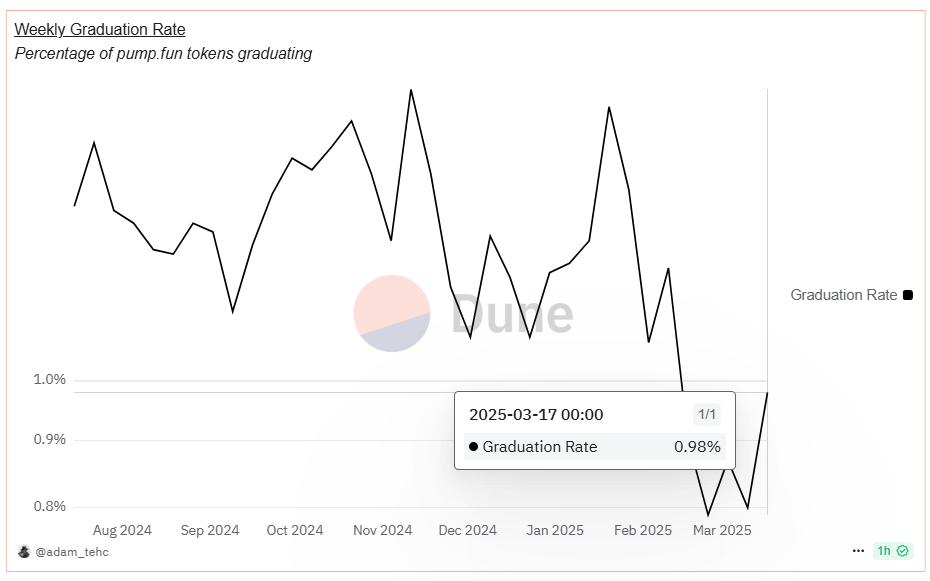

In addition to the drop in revenue, the cool-off of memecoin frenzy on Pump.fun is also evident from the decline in the platform’s graduation rate—the number of memecoins that make it to Solana (SOL) decentralized exchanges contingent on meeting specific liquidity and trading requirements.

According to Dune Analytics, Pump.fun’s graduation rate is currently at 0.98%, down from 1.62% on Jan. 20. Furthermore, it has remained below 1% for a month now, since Feb. 17. The decline in Pump.fun’s revenue along with its memecoin graduation rate suggests people are losing interest in Solana memecoins.

According to Matrixport, the bursting of the memecoin bubble after its peak in January has contributed to $1 trillion decline in the total crypto market cap—from $3.6 trillion down to $2.6 trillion. This is likely due to the recent high-profile pump-and-dump schemes, most notably the LIBRA memecoin fiasco involving Argentinian president as well as Trump’s tokens TRUMP and MELANIA.

In an effort to revive its revenue, Pump.fun recently released a mobile app and teased plans to launch an automatic market maker aiming to facilitate native trading and boost liquidity.