With Bitcoin hovering around $104,000, PlanB is already mapping a path to $400,000, though some see more fiction than forecast.

Bitcoin’s (BTC) recent rally to $104,000 has put bulls back in the driver’s seat. At least that’s the takeaway from PlanB, the pseudonymous analyst behind the Stock-to-Flow model. In a new video, he outlines why the party might just be getting started — and how the next stop could be $400,000.

PlanB pointed out that the market ended up staging a V-shaped recovery after all. Back in late March, Bitcoin was around $82,000. By the end of April, it had jumped to $94,000, and as of press time, it’s sitting at $104,000. To him, that wasn’t just a rebound, and it looked like a clear sign the bull market was back.

He’s sticking with his long-term model. The S2F average for the 2024-2028 halving cycle is $500,000. That number may sound far-fetched, especially today, but PlanB isn’t fazed, as he’s saying the market is only “one year into the cycle, with three years to go.”

Why so bullish

A big piece of the puzzle is Bitcoin’s relative scarcity. As PlanB reminds, Bitcoin is “twice as scarce as gold,” noting, though, that gold is “worth ten times more.” That, to him, screams undervaluation.

The chart that gives him confidence? His market cycle model. Created in 2022, it showed no “yellow” distribution signal when Bitcoin was at $82,000, a phase that usually precedes a bear market. Instead, the red signals he saw suggested bull continuation, calling it a “very weird, long, flat bull market.”

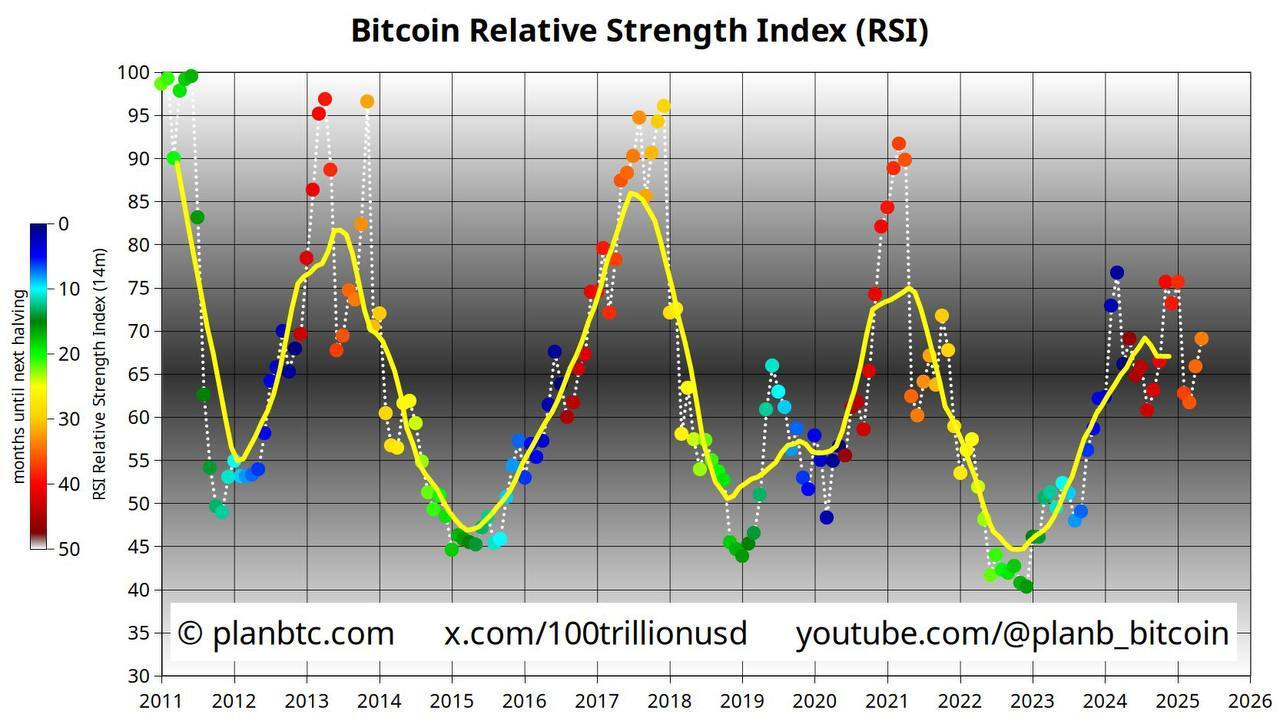

The analyst also referred to RSI, or Relative Strength Index, saying that right now, the metric is at 66, which is above average and rising.

“I think we’ll see 80+ RSI months again — at least four of them — just like in the bull markets of 2021, 2020, 2017, and 2013. […] If we’re at an average price of $100,000 now… that would already bring us into the $400,000 area.”

PlanB

Some agree, with caveats

Vugar Usi Zade, COO at Bitget, noted in an interview with crypto.news that PlanB’s $400,000 Bitcoin forecast leans on two pillars: a multi-year “four-phase” cycle and the S2F framework. He admitted that the timeline matches prior post-halving cycles, saying the market now sits “near month 12-15 of the current cycle — early but not alarmingly so.”

“PlanB’s $400k Bitcoin forecast leans on two pillars: a multi-year ‘four-phase’ cycle and the S2F framework. The timeline aligns with past patterns, but macro and market-structure changes inject far more uncertainty than in 2013 or 2017.”

Usi Zade

But this time, it’s not just retail and hype. There’s institutional capital, structured derivatives, and macro risks to consider.

“Unlike prior cycles, institutional adoption, regulated derivatives, and on-chain analytics now smoothen volatility and may extend cycles rather than compress them. But it’s important to consider that we face potential Fed rate pivots and geopolitical flare-ups. Such tail risks can abruptly truncate cycles. Also, a greater correlation to equities means Bitcoin may no longer behave as a stand-alone ‘digital gold’ store of value. Cycle timing can blur when broader risk assets sell off.”

Usi Zade

He also points out the move to $104,000 may not be entirely organic as April’s cooler inflation and dovish Fed tones triggered a broad “risk-on” rebound. According to Usi Zade, much of the move to $104,000 “could simply reflect short-covering and equity correlation.”

That makes the $110,000-$115,000 level critical as a failure there could see “rapid retracement toward $88,000-$92,000,” Usi Zade suggests.

As for the $400,000 target, the Bitget COO is even more cautious. He explains that while halving events do cut new supply and S2F did line up with prices in the past, the 2021 bull market broke the model’s predictive streak.

“So, S2F retains some heuristic value but no longer commands unqualified trust. Treat its $400k figure as a broad ‘upper-bound scenario’ rather than a hard forecast.”

Usi Zade

Usi Zade told crypto news that the $400,000 S2F target now sits more as an “aspirational upper bound” than a high-confidence price projection.

‘Everybody’s in profit’

Another bullish signal for PlanB: rising realized prices. The 5-month realized price for short-term buyers is $92,000 now, and Bitcoin sits above this level.

“That’s how we want to see it. That’s also a sign of a bull market. Everybody’s in profit. There’s not much pain in the market. We’ll see what that brings.”

PlanB

Even the 200-week moving average — a key long-term support — is ticking up. As of press time, it’s at around $47,000. For context: in previous cycles, this average marked the bottom. But now, PlanB sees the growing gap between that and price as more fuel for a bullish thesis.

Tracy Jin, COO of MEXC, agrees with PlanB on the mechanics, though isn’t convinced by the pace. Yes, Bitcoin can post huge monthly gains, but “not without significant retail participation fueling the rallies.” Right now, she points out, that retail frenzy hasn’t shown up.

“PlanB’s $400,000 projection aligns with historical patterns of exponential price moves during past bull markets. Still, this should not give investors the reason to treat such models as directional tools instead of precise forecasts. A better strategy is to have a diversified view, balancing on-chain data with macro trends, sentiment analysis, and risk management.”

Tracy Jin

The MEXC COO pointed out that although 40% monthly returns are possible, maintaining that level of momentum without widespread retail enthusiasm is unlikely. Jin calls today’s market “in transition,” explaining further that it’s “not fully bearish, but not yet in a full-fledged retail-driven rally.” Institutional players are definitely here, she says, adding that regulations have become tighter.

“While 40% monthly returns are not impossible, sustaining that level of momentum without broad retail euphoria is unlikely. Such aggressive moves would now require favorable macro conditions, institutional flows, and a strong narrative to drive market-wide conviction.”

Tracy Jin

‘Positive sign for altcoins’

Analysts at crypto payment gateway B2BinPay echoed some of the optimism but stressed caution. In a commentary for crypto.news, they noted that if Bitcoin starts moving below the $93,000 level and consolidates there, the market is “unlikely to see a quick move toward a new ATH.”

“Instead, the price may pull back into the $88,000-$86,000 range. However, if Bitcoin shows strength from here, breaks above its ATH, and manages to stay above it, we could start looking at the next target zones — anywhere between $124,000 and $134,000.”

B2BinPay

Addressing Bitcoin dominance, the analysts say they consider it as a “very positive sign for altcoins,” adding that on the daily chart, “we can clearly see a break of the uptrend line that had held since Dec. 3, 2024, through May 9, 2025.”

“That said, dominance is still at a relatively high level, and there’s a lot of liquidity built up below, most of it is compressed. And compressed liquidity tends to be released quickly. So, there’s a good chance we’ll see a fast move down to around 54% dominance, possibly sooner than expected. If that happens, altcoins might surprise us in a big way.”

B2BinPay

PlanB himself admits that some models “are wrong, some are useful,” but today’s market is clearly driven by more than just charts and halvings.

Central banks, global politics, and crypto’s correlation with broader markets all play a role. Keeping that in view, B2BinPay analysts aren’t expecting a sudden surge in volatility in the short-term as summer approaches, noting that “summer tends to be a quiet season in the crypto market.”