Pepe, the third-biggest meme coin, has been in freefall since December, but two chart patterns point to a strong rebound soon.

Pepe (PEPE) jumped to a record high of $0.00002833 in December before crashing by over 80% this month. This retreat has mirrored the performance of other meme coins, whose prices have dropped by double digits from their 2024 highs.

Pepe price has formed a falling wedge and a double bottom

Technicals suggest that Pepe may be on the verge of a strong bullish breakout in the coming days or weeks.

The daily chart shows that it has formed a falling wedge, a popular reversal pattern. This pattern consists of two descending and converging trendlines. The upper side of this wedge connects the highest swings since December, while the lower side connects the lower lows since November last year.

Pepe’s price has also formed a giant double-bottom pattern at $0.0000060. A double bottom consists of two lower swings and a neckline, which, in this case, is at $0.00002830, representing its all-time high. The double-top level also coincides with the strong pivot and reverse point of the Murrey Math Lines tool.

The Relative Strength Index has continued rising and has just crossed the descending trendline that connects the highest swings since January—a sign that it has completed a bullish crossover pattern.

Therefore, the Pepe coin price will likely have a strong bullish breakout, with the next target being at $0.00002095, the highest swing on January 19, which is about 220% above the current level.

A bearish breakout below the key support at $0.000002980, the weak stop and reverse point of the Murrey Math Lines, will invalidate the bullish view.

Potential catalysts for Pepe coin

Pepe has several potential catalysts that may push it higher in the coming weeks. First, the US published encouraging consumer inflation data. The report showed that the headline Consumer Price Index dropped from 3% to 2.8%. Core inflation, which excludes the volatile food and energy prices, fell from 3.3% to 3.2%.

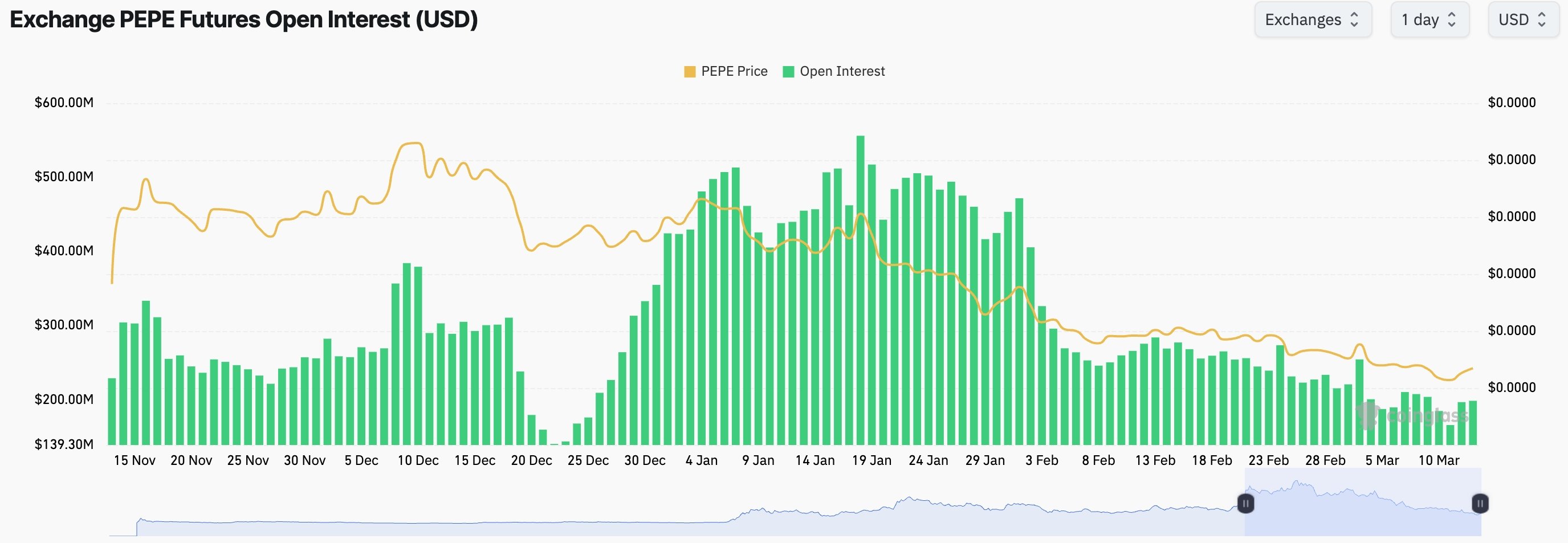

Second, Pepe’s futures open interest has risen in the past few days. It rose to $198 million on Wednesday, its highest level since March 7. The open interest remains much lower than the year-to-date high of $556 million. Historically, big price gains start when the open interest is low.

Third, astrology analysts anticipate that the ongoing crypto sell-off may end this week when the lunar eclipse happens.