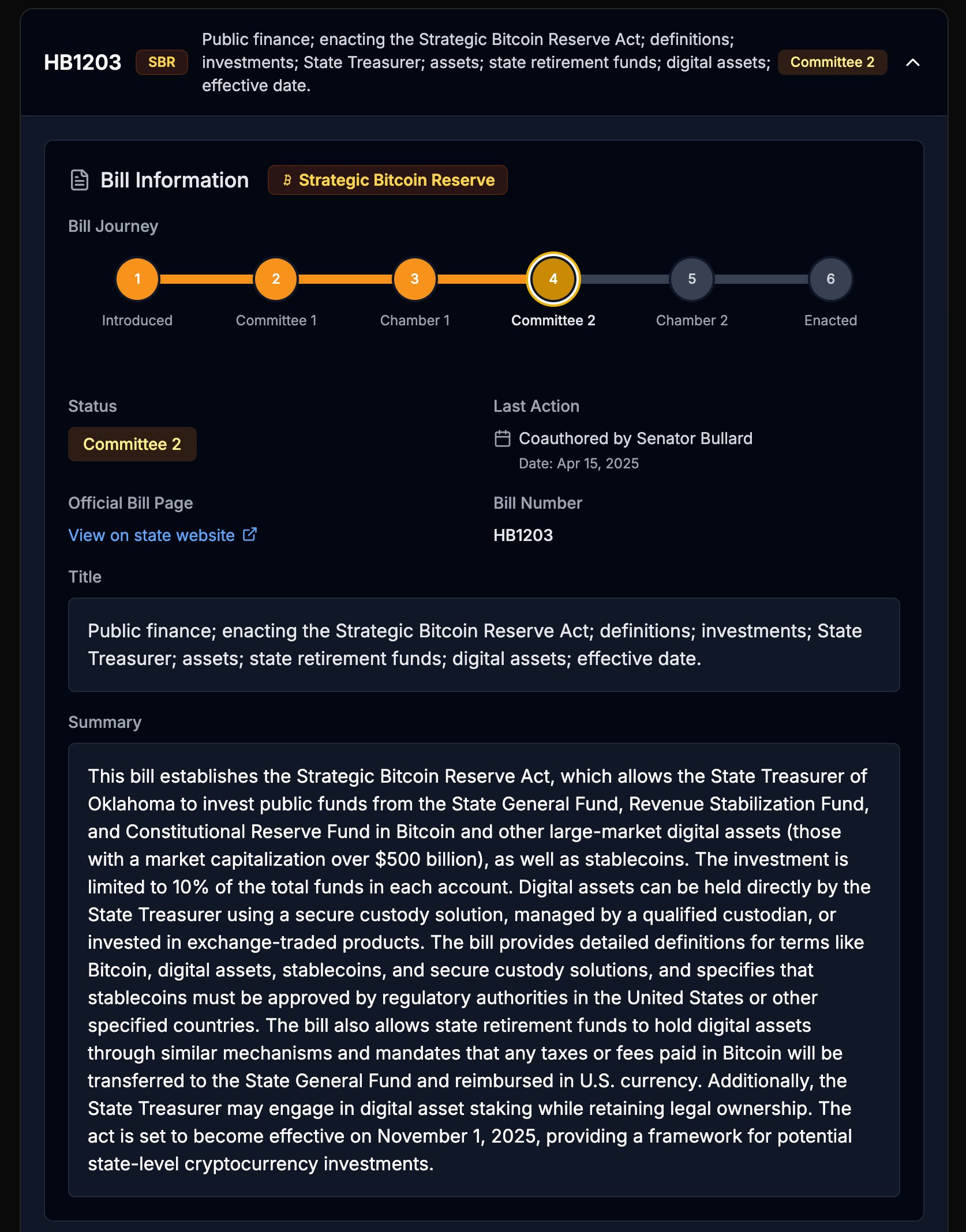

Oklahoma’s proposed Strategic Bitcoin Reserve Act (HB1203) has failed to advance in the Senate Revenue and Taxation Committee, following a narrow 6–5 vote against the bill.

The bill aimed to authorize the State Treasurer to invest funds from the State General Fund, Revenue Stabilization Fund, and Constitutional Reserve Fund in Bitcoin (BTC) and other major digital assets (with market caps over $500 billion), including stablecoins. Investments would have been capped at 10% of funds per account, and assets would be held with regulated custodians.

The bill also included provisions for using digital asset staking and integrating crypto investment options into state retirement funds. It specified that taxes or fees paid in BTC in must be converted into dollars before being transferred to the state treasury.

The bill was initially introduced to the Oklahoma House of Representatives on Jan. 15 by representative Cody Maynard, who voiced strong support for BTC as a hedge against government overreach and inflation., stating:

“Bitcoin represents freedom from bureaucrats printing away our purchasing power. As a decentralized form of money, Bitcoin cannot be manipulated or created by government entities. It is the ultimate store of value for those who believe in financial freedom and sound money principles.”

The bill then passed the Government Oversight Committee with a 12–2 vote on Feb. 25 and then the full House with a 77–15 vote on March 24.

However, HB1203 faced bipartisan opposition in the latest committee vote on April 14. The six “No” votes came from Senators Todd Gollihare (R), Chuck Hall (R), Brent Howard (R), Julia Kirt (D), Mark Mann (D), and Dave Rader (R).

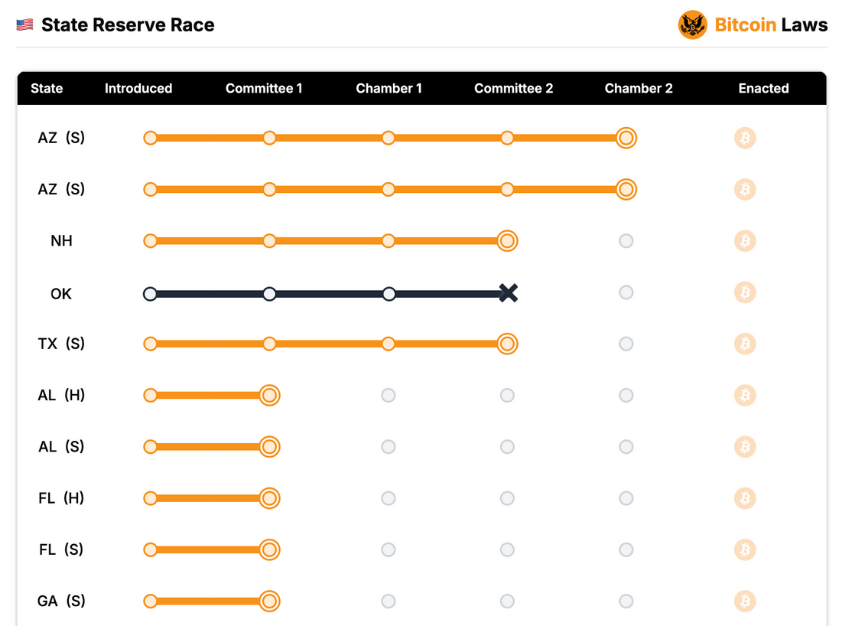

With this vote, Oklahoma exits the Bitcoin Reserve Race, leaving Arizona, New Hampshire, and Texas as leading contenders in the state-level adoption of crypto investment strategies. The bill, originally slated to take effect on Nov. 1 this year, will not move forward.