Ethereum price held steady as the market came to terms with the $1.4 billion hack by the Lazarus Group.

Ethereum (ETH) traded at $2,795 on Sunday, a few points above last Friday’s low of $2,665. It remains about 32% below the highest level in December last year.

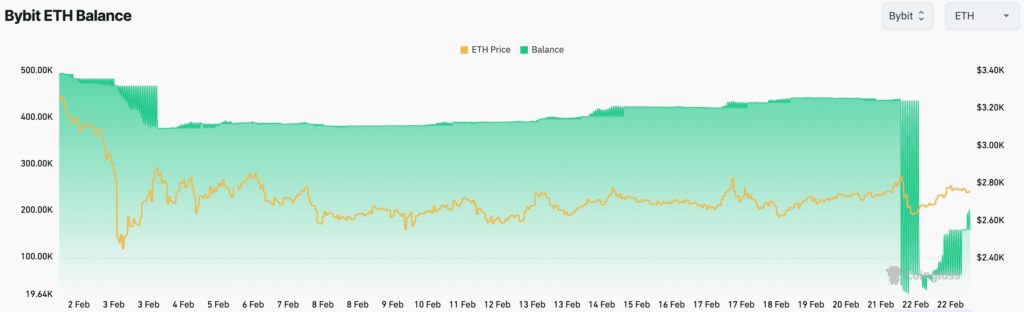

Coinglass data shows that Ethereum balances on Bybit have started rising after crashing on Friday following the hack. Balances rose to over 200,000 or $558 million, up from last Friday’s low of 61,000.

There are two potential reasons for the ongoing Ethereum balances on Bybit. First, there is a likelihood that Bybit is actively buying ETH from the market as it seeks to boost confidence with its users.

Second, the ongoing rise is a sign that customers are transferring ETH to the exchange as confidence rises. That’s because Bybit has maintained that it will cover 100% of the stolen Ethereum coins. Bybit has also launched a $140 million to track down the funds, a move that may see part of them returned.

These events are happening after North Korea’s Lazarus Group allegedly accessed Bybit’s cold wallets and stole ETH tokens worth $1.4 billion. In addition to its scale, this hack raised concerns about the safety of crypto assets stored in cold wallets, by exchanges.

Ethereum price may be at risk of a bigger dive

The daily chart shows that Ethereum may be at risk of a bigger dive in the near term. It has already formed a death cross pattern as the 200-day and 50-day weighted moving averages crossed each other. It is one of the most bearish chart patterns in technical analysis.

Ethereum price has also formed a bearish flag chart pattern, a popular continuation sign. This pattern is made up of a vertical line and a consolidation. This consolidation also resembles a rising wedge pattern.

Therefore, the ETH token will likely have a bearish breakdown, with the next reference level being at $2,155, the lowest point this year, which is about 23% below the current level.

The bullish outlook will become invalid if the coin jumps above the 200-day WMA point at $3,085.