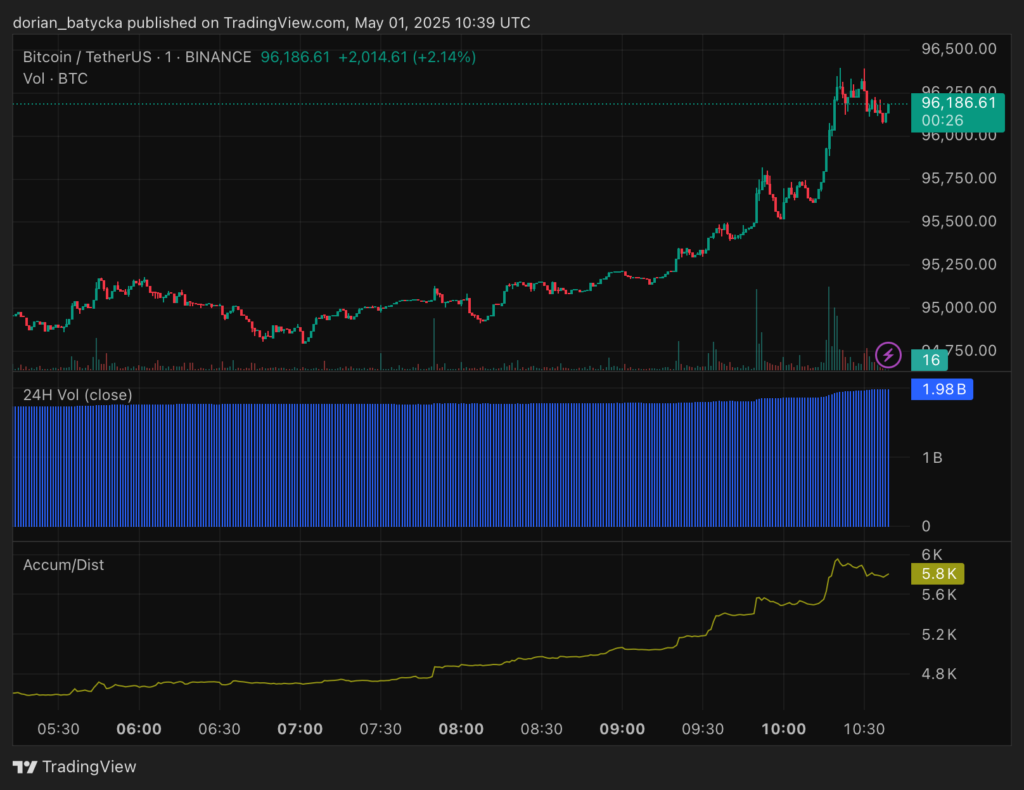

Bitcoin has reclaimed $96,000, a level not seen since late November 2024, driven by robust institutional demand and easing macroeconomic fears.

Bitcoin (BTC) rallied nearly 20% from its April low of $79,000, fueled by $381 million in ETF inflows and renewed optimism after U.S. President Donald Trump’s softened stance on China trade tensions.

However, analysts warn of resistance at $94,000-$95,000, citing heavy selling pressure in spot markets. With BTC still 16% below its January peak of $109,000, volatility remains a concern, especially as stock market correlations persist. Investors are eyeing whether BTC can sustain momentum amid global economic uncertainties.

On the heels of renewed institutional interest, particularly from large players like Strategy who have continued to acquire the original cryptocurrency over the last several months, BTC’s latest rally comes as new players have also emerged in the space. In particular, from Twenty One Capital, which this week announced it too would be acquiring billions of dollars worth of BTC in an attempt to shore away business from Strategy.