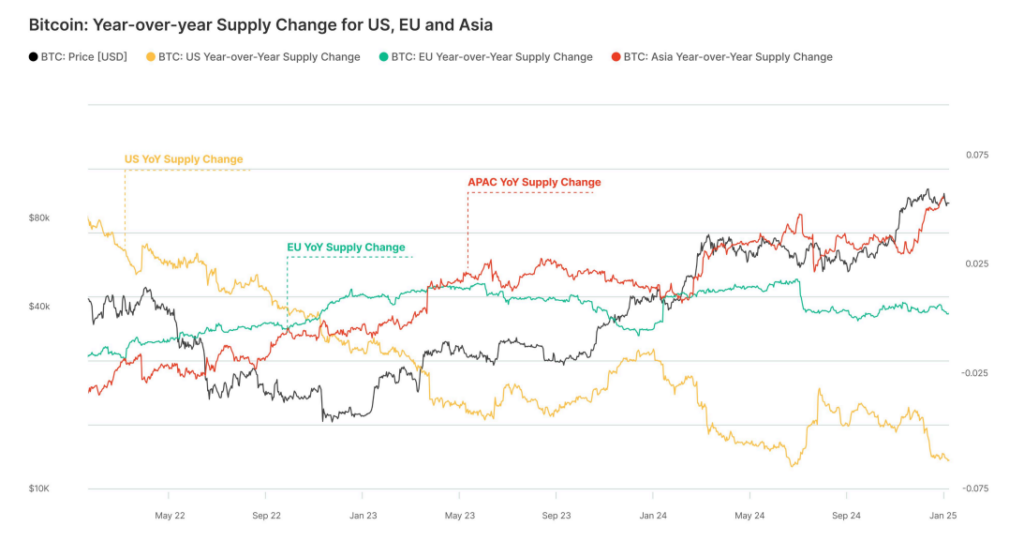

Retail Bitcoin activity in APAC has outpaced the U.S. and Europe, driven by non-institutional participation, according to Gemini and Glassnode.

The Asia-Pacific region retail traders are making moves in Bitcoin (BTC) while the U.S. lags behind. When excluding exchange-traded funds and exchange flows, retail activity in Asia is growing faster than in the U.S. and Europe, according to Gemini’s latest research report made in collaboration with Glassnode.

Research at Glassnode analyzed transaction timestamps, linking BTC activity to working hours in different regions. The findings suggest that “retail activity in the APAC region has grown at a faster clip than other geographies.”

Since Bitcoin’s cycle low in December 2022, APAC’s year-over-year supply growth reached 6.4%, the survey reveals. For comparison, the U.S. saw a decline of 5.7%, while Europe dropped 0.7% per the same timeframe.

“This observation is interesting, reflecting an inverse in behavioral activity between the U.S. and

APAC areas, suggesting a shifting dominance in retail activity between the two regions.”Glassnode

Institutional investors have played a big role in U.S. Bitcoin flows, especially after the launch of spot ETFs. But outside of ETFs and exchanges, APAC traders are taking the lead. The analysts say “it is likely” that the launch of the U.S. spot ETFs in January 2024 have played a key role in the trend, opening up “new opportunities for retail and institutional investors to get exposure to Bitcoin.”

Additionally, education and understanding of the asset class “has largely improved,” which led to a

“maturing investor profile,” Glassnode notes.